Contributed by Her Brave Soul

Two years ago, I quit my job to travel the world.

Now, wouldn’t that be such a badass opener? Unfortunately, as much as I want to book a flight and pack my bags, I cannot afford to do so. That is why while I am still preparing for my dream trips, I make short tours to our neighbour countries whenever I can.

What indeed happened when I quit my previous job was that I craved for that proud feeling of going on vacations with my own money. But I am also a bit of an investment freak. Every month, since I started working, I would save specific amounts of money for my Dream Tour, Emergency Fund, Untouchable Fund, Investments and others. I always want to keep my regular savings unharmed. So, if I cannot afford something, I will not do or buy it. Especially if it involves travelling, which is a lot costlier than my general expenditures.

But I really like to go on adventures, so I am glad that I tried following some of the money challenge calendars I saw online. In the beginning of 2015, my only goal was to save more money to use in investments. But in the long run, I realised that through discipline and determination, the challenge could take me to places.

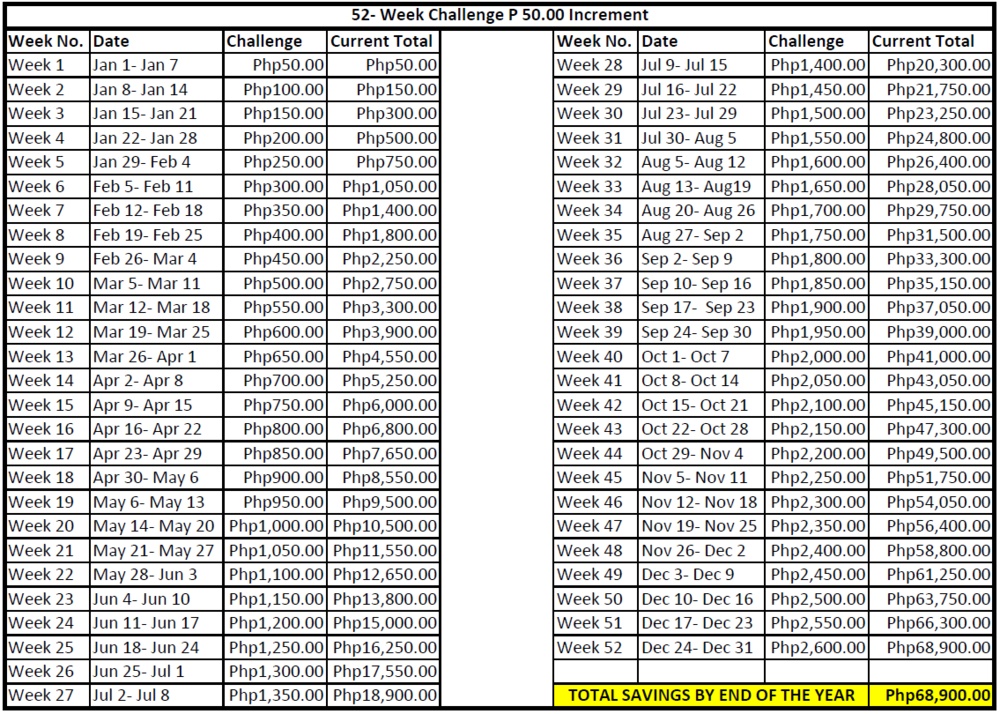

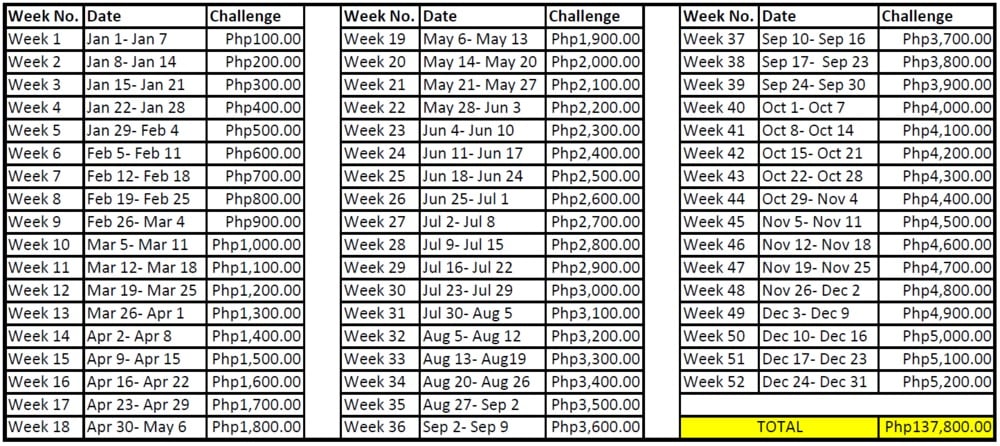

I am telling you; I was challenged extremely. But by the end of 2015, I was able to save ₱180,661. ₱137,800 was from the 52- week challenge following a ₱100 increment.

It became very hard to keep up after four months. I had weeks and weeks of delays. Whenever I got extra money aside from my monthly salary, I would feel relieved. I was constantly thinking about delayed gratification. I thought that if I tried my best to save as much as I can, I would be able to enjoy my money better later.

Also read: 10 Universal Tips on Saving Money While Travelling

With so many people doing money challenges, I made a slight modification. Unlike others, I did not keep my money in a piggy bank. Whenever I got the chance, I would deposit the money in the bank instead and invest them mainly in stocks and mutual funds. I only kept an Excel file to track where the cash from each savings challenge went. Instead of keeping everything and holding all ₱137,800 in December, I let my money work for me as early as March.

So, 2016 came, and I had a total of ₱180,661 from multiple money challenges. They were on my bank, stocks, mutual fund and UITF accounts. I opted to not to liquidate everything. I kept my investments where they were and split the total money into two. I allocated ₱90,000 for my trips for the rest of the year.

Because of the 52-week challenge, I was able to go to Japan, Malaysia, and Taiwan. Japan was a little easier because I was with my father and he spared me from some of the expenses. But I paid for everything for my Malaysia and Taiwan trips. Both are ten days long. Looking back at all the expenses I have incurred, I realised that I did not even spend ₱90,000 in total. So, I kept the change and carried it over to my 2017 travel fund.

Also read: How I Travelled Solo in Japan for 5 Days: Budget & Tips for Filipinos

There were some things that I needed to sacrifice (mainly books I resisted to buy whenever I visited bookstores), but it was worth it. By merely saving and travelling, I got to cross a couple of items out of my bucket list this 2016. And most importantly, I was able to get high of that feeling of independence.

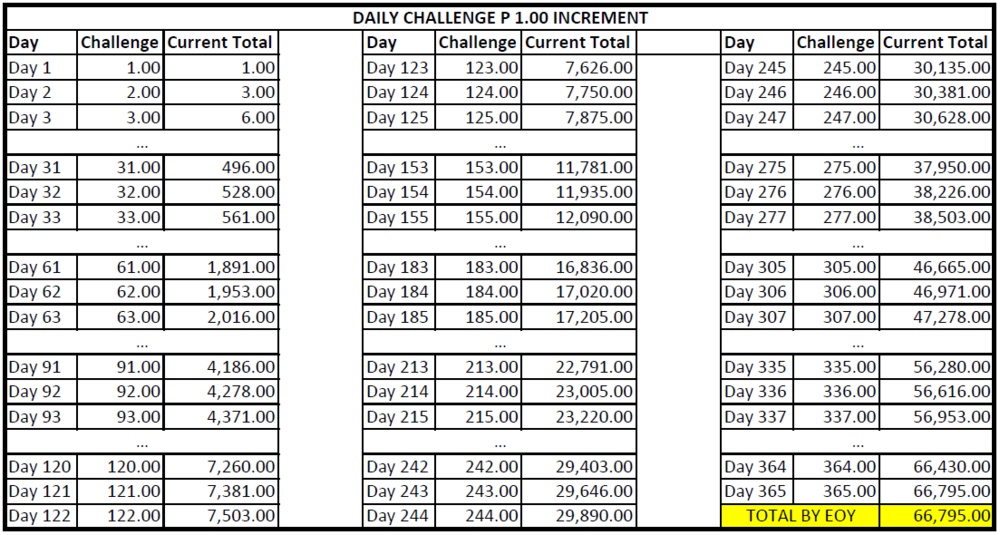

2016 has come to an end, and I completed the same challenge. I even finished daily and monthly challenges. Some of the savings, like the last year, has already been invested while others are still sitting in my bank account. I will be using around 30% of it to fund my travels for 2017, and I have an exciting lineup!

Saving is possible if you are determined. Small amounts can make a huge difference if there is consistency. There are many forms of saving and we just have to find what amount or strategy works well for us depending on our situations.

Ultimately, what we do after completing the calendars is what matters. Do we spend our cash on important or useless things?

Some opt to invest everything. Some use the money as down payment for a car or a house. Others buy insurance, a new gadget or home appliance. I chose to split mine for investment and travel fund, and I think I am satisfied with the outcome. I can enjoy my money while letting some of it work for my retirement.

Also read: Why Money Spent on Travel is the Best Money Spent

It is so satisfying to see your money grow from the first week of the challenge until the last. It is also rewarding to know that instead of unconsciously spending your spare on insignificant things — things that will not be valuable in the next five years — you get to use it for the possessions that really matter.

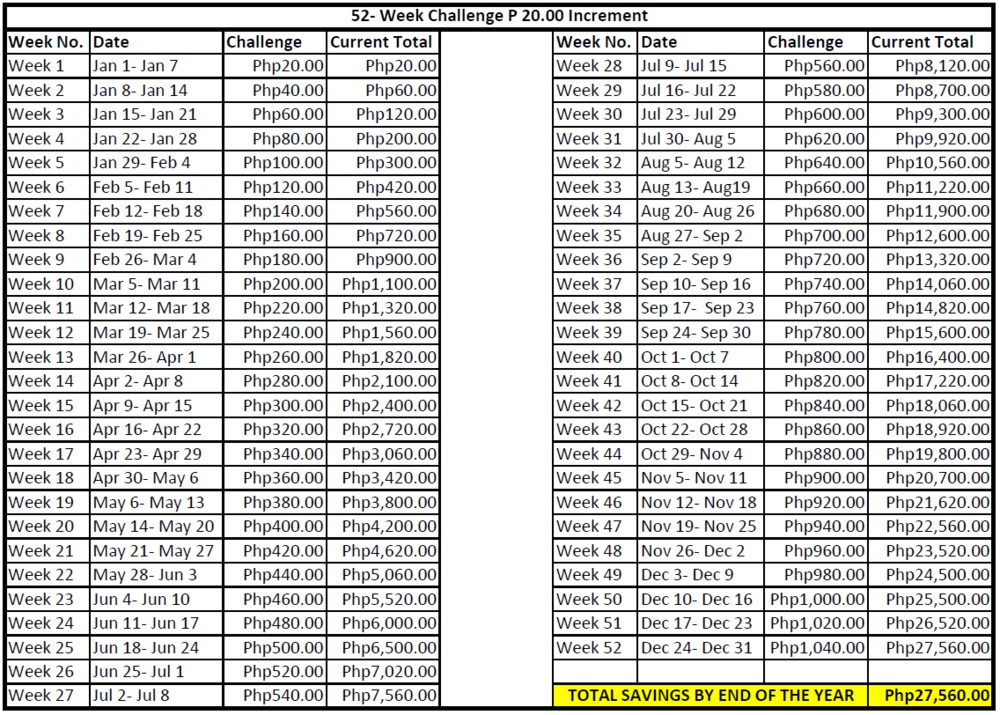

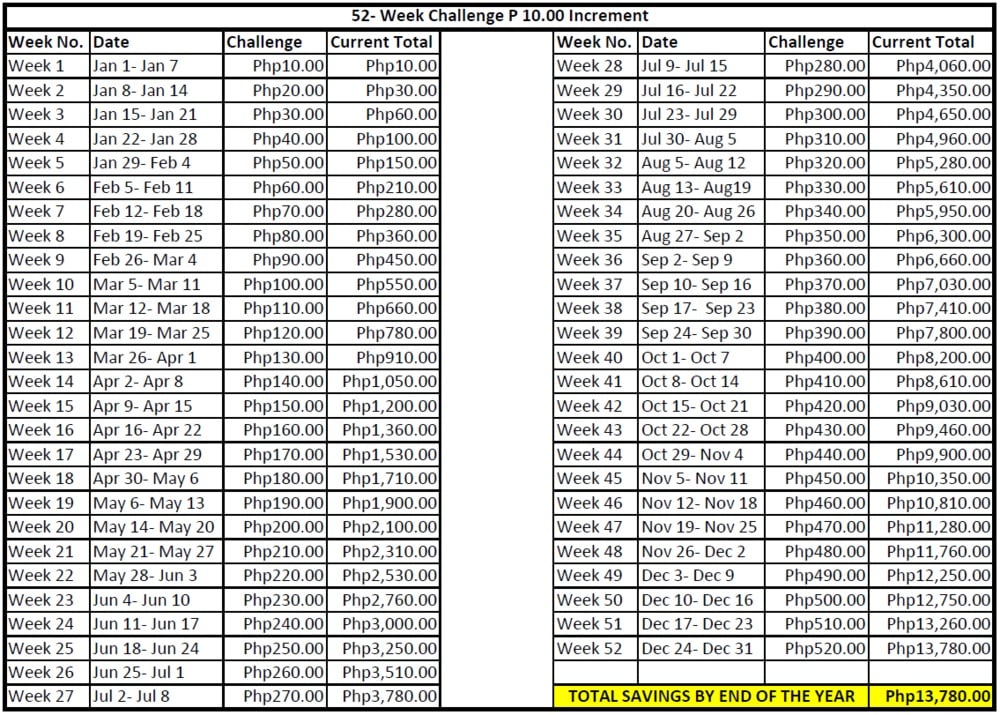

We may follow Daily, Weekly or Monthly Money Challenges with increments from ₱1 to ₱100, but one thing is for sure — saving money will get us to places.

Update: I have noticed that some of the readers are discouraged because I followed the ₱100 increment. So, I have included calendars for ₱50, ₱20, ₱10, and ₱5 increments. There is even a Daily Challenge! There are so many savings calendar we can get online (or even design ourselves). It is up to you guys which calendar is most convenient for you to follow. Happy Saving!